Description

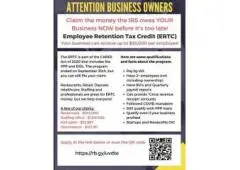

Claim the money the IRS owes YOUR Business NOW before it's too late!

Employee Retention Tax Credit (ERTC) Your business can receive up to $26,000 per employee!

The ERTC is part of the CARES Act of 2020 that includes the PPP and EIDL. The program ended on September 30th, but you can still file your claim.

Restaurants, Retail, Daycare, Healthcare, Staffing and professionals are great for ERTC money, but we help everyone!

A few of our clients: Restaurant - $243,000

Staffing office - $1,201,063 Nail salon - $32,587

Optometrist - $127,911

Here are some qualifications and facts about the program.

• Pay by W2

• Have 2+ employees (not including ownership) • Have 941's and Quarterly payroll reports

• Can provide "Gross revenue receipt" amounts

• Followed COVID mandates • Still qualify with PPP loans

•

Qualify even if your business profited

Startups and Nonprofits OK!

Apply at the link below or scan the QR code

https://fundwiseagents.com/2m?via=fred83